Blog

Top Trends Shaping the US Chemical Industry in 2023

In 2023, the US chemical industry is witnessing a dynamic transformation driven by several key trends that are reshaping its landscape. As the nation grapples with the implications of sustainability, innovation, and technological advancements, companies within this sector are adapting to meet evolving market demands and regulatory requirements. The significance of the US chemical industry in the global market cannot be overstated, as it plays a crucial role in various sectors, from pharmaceuticals to agriculture and energy.

Amidst challenges such as supply chain disruptions and the pressing need for greener practices, the industry is embracing new methodologies and processes that align with sustainability goals. The shift towards a circular economy and the increased investment in clean technologies are pivotal trends that not only enhance operational efficiency but also contribute to a more sustainable future. Furthermore, the rise of digitalization is facilitating better decision-making and resource management, allowing companies to remain competitive in a rapidly changing environment. As we delve into the top trends shaping the US chemical industry in 2023, it is essential to consider how these factors interplay to foster growth and innovation while addressing societal and environmental responsibilities.

Key Regulatory Changes Impacting the US Chemical Industry in 2023

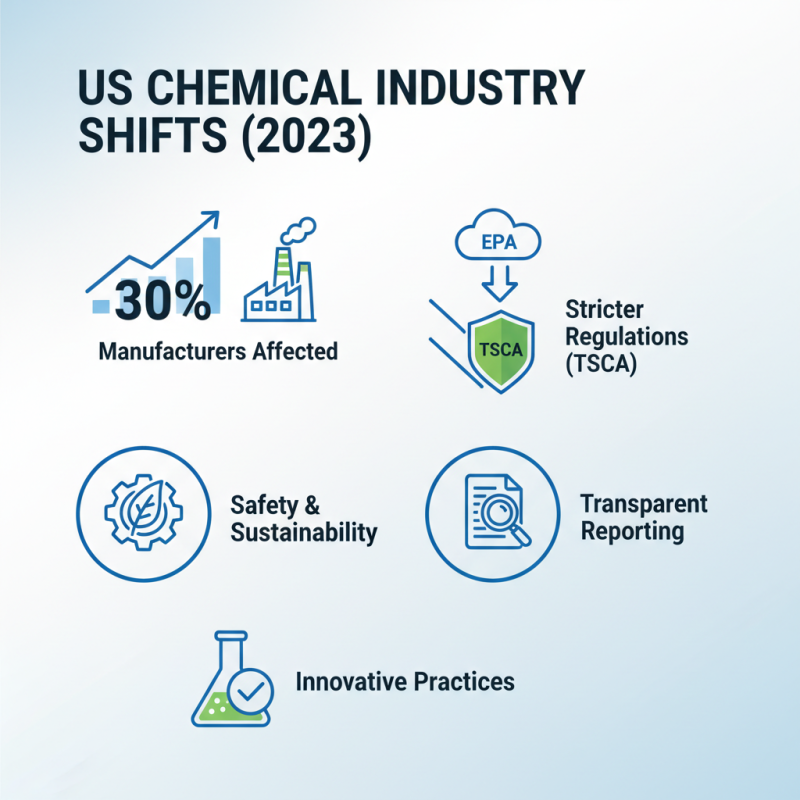

In 2023, the US chemical industry is experiencing significant shifts driven by key regulatory changes that aim to ensure safety, sustainability, and environmental responsibility. The Environmental Protection Agency (EPA) has intensified its scrutiny of chemical manufacturing practices, implementing stricter compliance requirements under the Toxic Substances Control Act (TSCA). Reports indicate that these changes are expected to affect nearly 30% of manufacturers—pushing them to reevaluate their chemical portfolios and reconsider the safety of substances they use. This regulatory evolution underscores the importance of transparent reporting and innovative practices within the industry.

Additionally, the Chemical Safety and Hazard Investigation Board (CSB) has launched initiatives focusing on enhancing process safety management regulations. With industry accidents prompting policy revisions, companies need to prepare for more rigorous accountability measures. A recent industry analysis estimated that around 40% of chemical facilities might have to invest in new technologies to meet these evolving regulations. As a response, firms are advised to prioritize safety audits and employee training programs to foster a culture of safety and compliance.

Tips: To navigate these regulatory changes effectively, companies should invest in compliance software that tracks regulatory updates and ensures adherence to new standards. Engaging with industry professionals and networking at conferences can provide valuable insights into best practices for compliance. Fostering a proactive culture focused on safety and sustainability will not only align with regulatory requirements but will also enhance the company’s reputation and competitive edge in the market.

Emerging Technologies Revolutionizing Chemical Manufacturing Processes

The chemical manufacturing landscape in the United States is undergoing a significant transformation as emerging technologies redefine traditional processes. Innovations in automation, artificial intelligence, and data analytics are streamlining manufacturing operations, leading to greater efficiency and reduced environmental impact. For instance, the use of AI-driven predictive maintenance allows manufacturers to anticipate equipment failures, minimizing downtime and maintenance costs.

One of the most notable trends is the implementation of advanced biotechnologies. These processes harness biological systems to develop sustainable alternatives to conventional chemical production. This shift is not only environmentally friendly but also allows for the creation of more complex chemical compounds with precision. By integrating biotechnologies, companies can reduce reliance on petrochemicals and promote a more circular economy.

**Tips:** To stay competitive in this evolving landscape, companies should invest in training their workforce on new technologies. Encouraging collaboration between teams can foster innovation, ensuring everyone is aligned with the latest manufacturing trends. Also, considering partnerships with tech startups can provide access to cutting-edge solutions that drive chemical manufacturing toward sustainable practices.

Top Trends Shaping the US Chemical Industry in 2023 - Emerging Technologies Revolutionizing Chemical Manufacturing Processes

| Trend | Description | Impact on Industry | Emerging Technology |

|---|---|---|---|

| Sustainability | Focus on eco-friendly practices and reducing carbon footprint. | Increased demand for green products and processes. | Bioplastics, renewable feedstocks |

| Digital Transformation | Integration of digital technologies in chemical manufacturing. | Enhanced efficiency and decision-making. | AI, IoT, data analytics |

| Circular Economy | Recycling and reusing materials to minimize waste. | Reduction in raw material costs and waste processing. | Chemical recycling technologies |

| Advanced Materials | Development of high-performance and multifunctional materials. | Broader applications across various industries. | Nanotechnology, smart materials |

| Decarbonization | Use of alternative energy sources and carbon capture technologies. | Compliance with regulations and market competitiveness. | Hydrogen economy, carbon capture utilization |

Sustainability Initiatives Driving Innovation in Chemical Production

In 2023, sustainability initiatives have emerged as a central focus for driving innovation within the US chemical industry. The increasing awareness of climate change and environmental degradation has prompted companies to rethink their production processes, embracing greener technologies and renewable resources. This shift is not merely a compliance measure; it is recognized as an opportunity for differentiation and competitive advantage. Firms are investing in research and development of eco-friendly materials, bio-based feedstocks, and circular economy practices, demonstrating a commitment to both sustainability and economic viability.

Moreover, collaborations across sectors play a crucial role in advancing these sustainability efforts. Chemical manufacturers are partnering with academic institutions, governmental bodies, and other industries to share knowledge, resources, and technologies. Such cross-industry collaborations not only enhance innovation but also accelerate the adoption of sustainable practices. As organizations strive to reduce their carbon footprints and improve resource efficiency, the integration of sustainable initiatives becomes a catalyst for transformation, positioning the chemical industry as a key player in the broader global movement towards sustainability.

Market Dynamics: Supply Chain Challenges and Opportunities

The US chemical industry in 2023 is navigating through a plethora of market dynamics, particularly in its supply chain. After the disruptions experienced during the pandemic, companies are focusing on building more resilient supply chains. This involves rethinking logistics networks, diversifying suppliers, and investing in technology to enhance transparency and efficiency. As companies strive to mitigate risks, there is a significant emphasis on local sourcing and sustainability practices, which are not only conducive to reducing lead times but also appealing to environmentally conscious consumers.

**Tips:** To improve supply chain resilience, consider adopting advanced analytics tools to predict potential disruptions. This data-driven approach allows companies to strategize proactively, ensuring that they can respond swiftly to unforeseen challenges. Collaboration with suppliers to create more flexible agreements can also mitigate risks and enhance overall supply chain agility.

Additionally, as the industry shifts towards digital transformation, leveraging automation and IoT technologies remains crucial. These innovations provide real-time data, helping businesses optimize inventory levels and improve production schedules. Embracing a culture of continuous improvement can help organizations stay ahead in a competitive landscape, turning potential challenges into opportunities for growth and enhancement in their supply chain strategies.

Trends Shaping the US Chemical Industry in 2023

This chart illustrates the major trends influencing the US chemical industry in 2023, with a focus on the impact of supply chain challenges, sustainability initiatives, digital transformation, regulatory compliance, and innovative product development.

Shifts in Consumer Demand Influencing Product Development Strategies

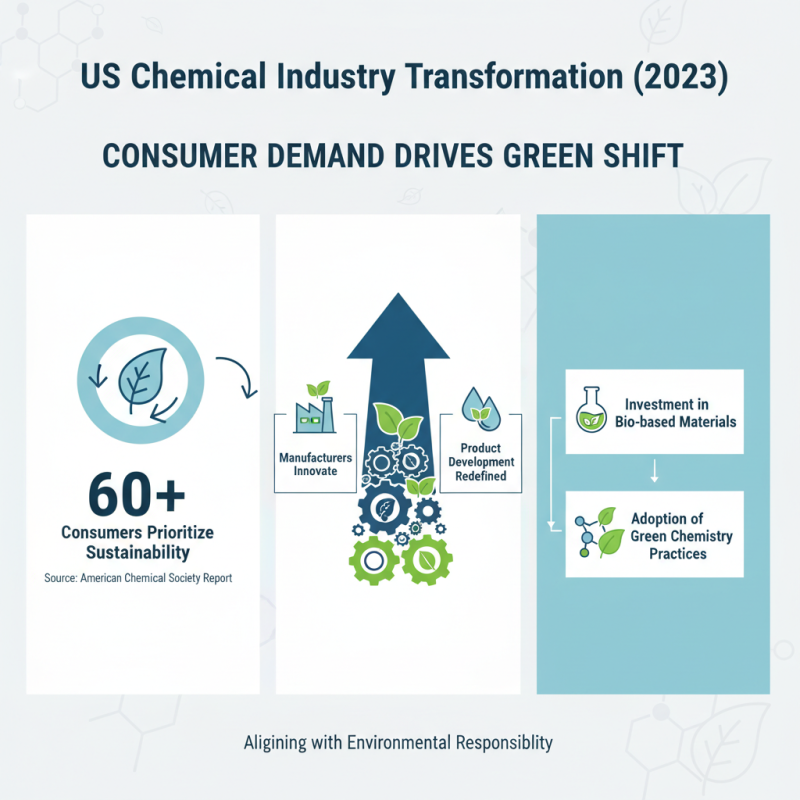

In 2023, the U.S. chemical industry is experiencing a profound transformation, driven significantly by shifts in consumer demand that are reshaping product development strategies. According to a report from the American Chemical Society, over 60% of consumers are now prioritizing sustainability and eco-friendly products, pushing manufacturers to innovate in their offerings. This heightened awareness is prompting chemical companies to invest in bio-based materials and green chemistry practices, aligning their production processes with the growing trend of environmental responsibility.

Additionally, the rise of e-commerce and digital platforms is influencing how chemical companies approach product development. Research from the Chemical Industry Association indicates that nearly 45% of chemical companies are enhancing their digital presence to better meet customer needs. This shift includes developing targeted products that cater to niche markets and improving supply chain efficiency to respond swiftly to changing consumer demands. As a result, the industry is not just focusing on traditional markets but is also exploring new avenues such as specialty chemicals, which are projected to grow at a CAGR of 5.2% through 2026. This aligns with the increasing consumer preference for personalized and tailored chemical solutions, marking a significant shift in the industry's landscape.